A long long time ago, one of my classmates happened to read one of my blog entries about taxation. He commented that my English has come a long way but I should under no circumstances write about economics or money. But recently I've started to watch the US stock market, more out of curiosity than actual expectations of profit.

Since I'm neither an investor nor a trader there, unlike most ticker watchers, I was interested in watching the ebb and flow of the stock prices rather than scramble to buy or sell. Considering the (rise and) fall of the petro dollars ever since the new millennium dawned, the dollar value is merely a transactional discrepancy for an outsider. Gold is rather more stable to compare against, especially considering the unique situation India is in terms of gold demand and consumption.

The frontrunner of the Web 2.0 stocks has been Google's IPO. The stock which was priced (possibly overvalued) at 300+ USD was and still is riding on the investor confidence thanks to the recent products (albeit Beta) which have come out of the Google stable. Then, suddenly Google insiders decide to get a little cash out of the market and into their pockets. The sell was more massive than all the other 199 companies put together and basically was a shot in the arm for California's treasury in tax dollars. It could be said that the sales wouldn't affect the economy as the money never really left the market but merely got converted into scrips. But the more important question to ask is whether this is a precursor to something more dramatic (always a good idea to watch CFOs selling stocks).

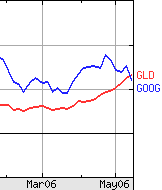

On the other hand, we see another trend marked up against Gold versus the stock market. Technically speaking, the stock market should be ahead of the curve on Gold in the growth sector mainly because of the risk involved (which should be compensated by increased returns and vice versa). But very recently, that has stopped being true for GOOG stock. This is probably more a reflection of the falling value of the dollar rather than the intrinsic value of the stock in particular but the trend in itself is disturbing.

I' m not the smartest dude in the world, but even I would be hedging my bets in tech stocks if I held a few million of these. So it is probable that these two events are related in some way, but to speculate whether one event was in anticipation of another would be completely irresponsible. In fact, if I were a Wall Street mogul I'd be convincing you to buy while I sold off all of mine slowly (just like the old times in '99).

In conclusion, something's cooking.

** disclaimer ** : these are very much my own opinions and I am a code monkey @ Yahoo!, so if you do something stupid based on these, Y'all can go to this excellent village ["Yee Haw !"] that's missing its idiot.

--The only thing necessary for the triumph of evil is for good men to do nothing.

-- Edmund Burke

posted at: 00:31 | path: /observations | permalink |